by Jeremy Barnes, CEO

niche (noun) — denoting products, services, or interests that appeal to a small, specialised section of the population

Many investors are wary of niches as they are, by definition, small, harder to analyse fully, and typically require specialist skills and experience to be successful. The easier and presumably safer option is to follow the herd into large, more generic investment opportunities.

The perfect niche is one which has a sustainable market, has some measure of non-correlation with other asset classes, has defensive qualities to protect the downside, and yet which is also capable of delivering above-average returns on the upside. The trick, therefore, is to find an opportunity with barriers to entry which beget better than average returns relative to the broader sector it is a part of. At the same time, the niche opportunity needs to proffer investment opportunities with defensive qualities, which, in more volatile and recessionary times, are typically supported by fundamental economic value. To be able to benefit from the convergence of these two factors requires an experienced team who truly understand the niche and who are very well placed to make and then manage the investments through economic cycles.

The pandemic was probably the most extreme test of niche investments, and how these fared throughout it speaks volumes. Did the defensive qualities of the underlying assets shine through, or did the niche become a grave? Furthermore, did the GPs with very specialist knowledge of the niche provide further protection, whilst at the same time, exploit the market conditions to provide further investment opportunities?

A very good example of a niche investment sector is the regional aircraft market. Over the next 20 years, this is forecast to comprise a worldwide fleet of 10,950 worth approximately $650 billion of capital, 1 as the in-service fleet requires some replacement of ageing aircraft. Whilst $650 billion might not feel like a niche in absolute terms, it can be defined as such because the regional market is dwarfed in value and unit terms by the broader aircraft market, a multi-trillion-dollar industry.

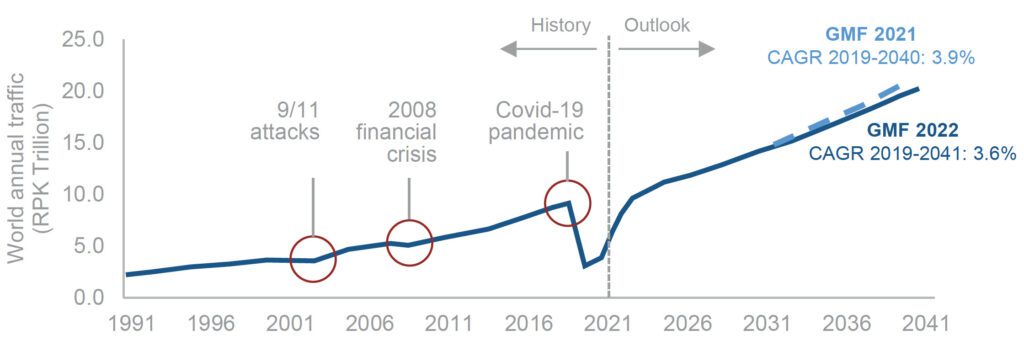

The demand for aircraft is long-term and sustainable, with the primary driver being growth in passenger numbers. These have risen inexorably over the decades and have shown remarkable powers of recovery in the face of existential events such as the Global Financial Crisis (GFC) and the Covid-19 pandemic, which had a 30 times greater impact on the industry relative to the GFC.2

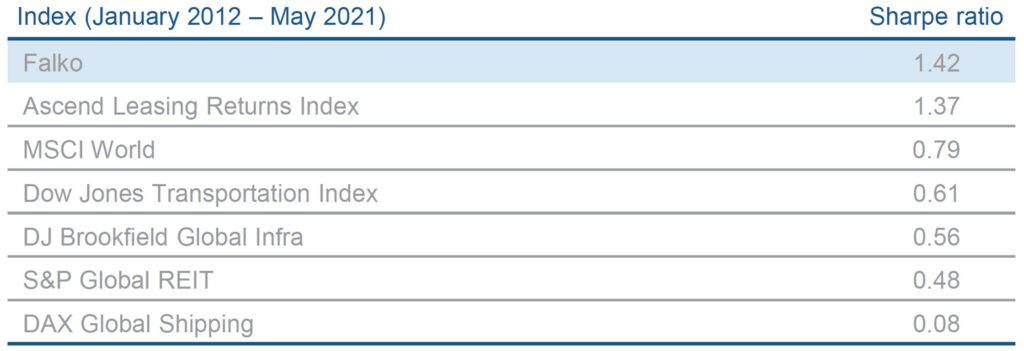

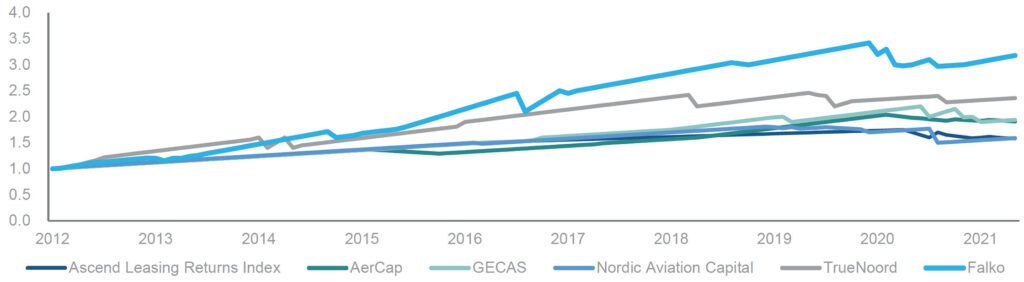

On a risk-adjusted return basis, aircraft leasing has yielded superior results to other asset classes such as infrastructure, shipping, and REITs over the past nine years. While returns generated by other asset classes that are often compared to aircraft leasing can be greater volatility, therefore offering a lower risk-adjusted return.

Figure 2, an index of returns from aircraft ownership, illustrates the defensive qualities of the niche. The key highlights are, firstly, that even in the GFC of 2008 the regional aircraft leasing market generated a positive return, whereas its larger brothers and sisters made negative returns in the period. Secondly, the regional aircraft sector exhibits greater bounce-back ability than the larger aircraft market, as shown in movement of the index through the recent pandemic.

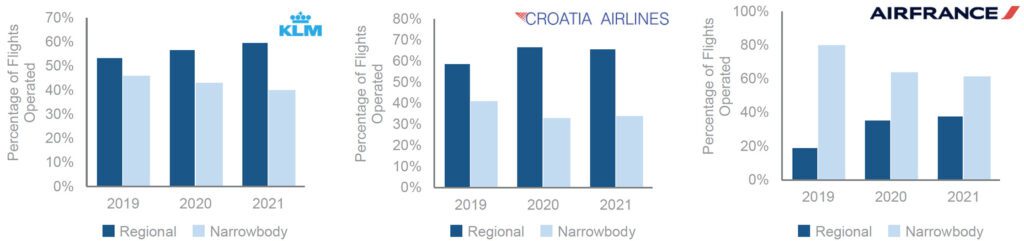

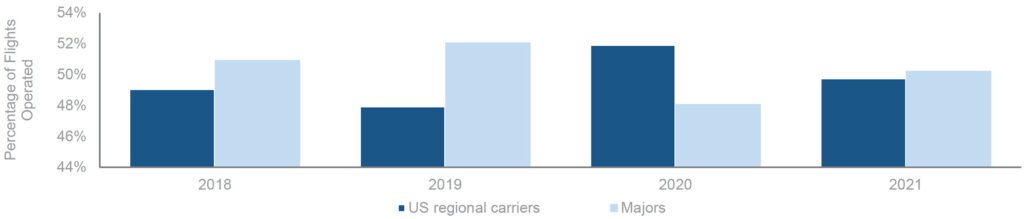

To the layman, the natural assumption would be that all aircraft are the same, so how can this be? The short answer, is that regional aircraft have fundamental utility value and therefore become vital economic assets to their operators, who seek to retain their flying schedules, even if limited, in times of volatile passenger numbers. In essence, the operators turn to the basic economic principles of flying the aircraft with the lowest operating cost for any given route. This consequently gives them the best chance of making a profit from flying, whilst at the same time protecting against the downside risk of very low passenger demand. Figures 4 and 5 demonstrate how some major airlines changed the structure of their flying operations through the pandemic — meeting the challenge of continuing to fly, as they had to do, whilst minimising the financial risk this entailed.

A natural retort at this juncture is that if the niche is so good then why has more capital not found its way into the sector to drive returns down to the levels of the larger aircraft leasing market? The answer is contained within the definition of ‘niche’: it is specialised, and this specialisation creates meaningful barriers to entry. In the case of the regional aircraft market, these barriers derive from the fact that the aircraft are much more mission-specific. There is little difference between a 180-seat Airbus and Boeing aircraft. By contrast, regional aircraft do different jobs for the airlines, allowing them to access specific routes and regions.

Similarly, exploiting the niche requires a specialist set of skills. Whilst the aircraft leasing sector is hugely data-rich and it may be tempting to try to raise some capital, build a new algorithm and start pumping out money in some sort of ‘Moneyball’ approach, the data is not perfect and squeezing the returns out of regional aircraft is not a spreadsheet exercise. The key ingredient is a high-quality GP with the full array of means to extract every cent from investments; they need the experience, network, market position, proven asset trading capability and, last but not least, portfolio and risk management tools. The market is not wholly driven by pursuit of the last dollar, but rather by execution capability and long-term relationships.

If you combine the returns from a niche market with the ‘smarts’ of a best-in-class GP, the outcome is significant outperformance versus the broader aircraft leasing market and other major competitors.

The challenge with investing in niches is having to overcome the barriers to entry in order to benefit from all the qualities that prevail therein. These defences can be pierced only by a high-quality GP who has the access and the experience of investing in the niche.

Upon reflection, perhaps I should have entitled this article ‘The power of the niche GP’.

As published in the Evercore State of the Market 2023 publication

Referenced information has been extracted from third-party product. The source providers have not seen or reviewed any conclusions, recommendations or other views that may appear in this document and make no warranties, express or implied, as to the accuracy, adequacy, timeliness, or completeness of its data or its fitness for any particular purpose. The source providers disclaim any and all liability relating to or arising out of use of its data and other content or to the fullest extent permissible by law.